I see a lot of misconceptions here.....

ITEM 1: Inflation, or nominal vs. actual

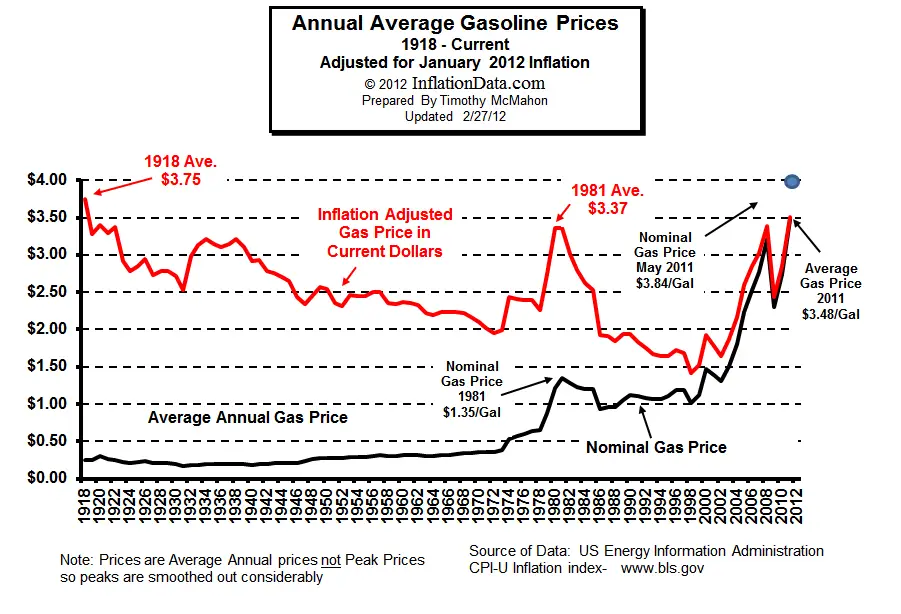

First, you need to understand the difference between actual price, and nominal price. Actual price is what you are paying for something, using inflation-adjusted dollars. Nominal pricing is whatever the price tag says.

Historically speaking, the price of gas mostly been increasing in name only. In other words, what we have been paying for gasoline has actually been falling, not rising, for most of the last 30 years. In actual, inflation-adjusted dollars, what has actually been happening is this:

So even today, we're actually paying about the same amount as we paid in 1981.

ITEM 2: The change since 2002

Things were quiet during the 1980s and 1990s; this was primarily due to the Iran-Iraq war. Both countries were pumping out furious amounts of oil, in an effort to gain foreign currency to fund their wars. This kept oil prices low during the 1980s, and was - in fact - the only real economic improvement for the country during the Reagan years.

Then around 2002, we started seeing a spike in the both the nominal and the inflation-adjusted price of oil. The causes were:

1. Bush Administration fiscal policy - the Bush adminstration did not want to raise taxes. So instead, they began borrowing money to pay for the Afghanistan and Iraq Wars. This was accomplished by selling US Treasuries abroad, principally to China and Japan. Money flowed into Washington to fund the wars, but this came at a cost: the US dollar was weakened. Currencies float. That means that the value of the US dollar changes all the time. So do other currencies. If your currency has lost 20% of its buying power since last year, then goods will be re-priced to reflect that. So to you (and anyone using your currency) it *appears* like - and *feels* like - a 20% price hike. But the absolute price of the item hasn't changed; only your currency's value has.

All told, this Bush fiscal policy caused a 43% devaluation of the US dollar's buying power between 2001 and 2007. Your dollar bought 43% less goods and services in 2006 than it did in 2001.

Since oil is one of the few commodities that is dollar-denominated (sold in dollars only), then producers reacted. When the dollar started falling, the oil producers simply adjusted the price per barrel upward so that they didn't lose anything. So any country unfortunate enough to be using dollars would see the price of oil jump way up. On the other hand, countries that used other currencies would only see a small jump.

Here is what this means in real terms:

On Bush's inauguration, you could have bought a barrel of oil for $30. In October of 2007, oil was $89 a barrel. Thus, of the $59 increase in the cost of a barrel of oil to a U.S. consumer, more than $30 is due to the depreciation of the U.S. Dollar and the fiscal and trade policies that have contributed to it.

2. Mideast instability - Afghanistan, Iraq, Iran;

3. The rise of Chinese industrial and consumer demand - more factories producing goods and more people driving cars;

4. Market speculation in oil - Here is the a chart of the price of oil per barrel right after the 2008 banking crash:

http://en.wikipedia.org/wiki/File:Brent_Spot_monthly.svg

Notice the sharp drop in 2009. Oil plunged from $147.27 per barrel in July of 2008 to $30.28 a barrel by Jan of 2009. The majority of that fall happened in the summer and autumn, right after the implosion of Bear Stearns, the September crash of Lehman Brothers, the absorption of Merill-Lynch, etc.

That represents a 79% decline in price in about six month's time. Worldwide demand did not fall by 79% in six months. This was the work of futures speculators.

ITEM 3: why drilling more oil / offshore / etc. is not the answer

Some people seem to think that oil drilled off the American coast has a nice shiny label on it, and must be sold in America. It doesn't work that way. Oil is a commodity - just like corn, soybeans, copper, coffee, cocoa, etc. As such, it gets traded on global commodities markets. All oil drilled offshore of the USA goes to the WORLD spot market (commodity market) for petroleum. It does not stay in the USA. Once on the world market, it gets sold to the highest bidder - China, India, Argentina, whoever. There are NO laws saying that the oil must stay in the USA for Americans to use.

So every time some oil executive or right-wing talking head tells you that we need to open up more drilling in the USA to achieve "energy independence", you can know right off the bat that they are lying to you. All they're trying to do is boost oil company profits - and sell the oil to the highest bidder. It does nothing for energy independence.

So until/unless we have a law that requires all oil drilled in the USA to be bought and sold here, then that oil will continue to be sold on the world spot market. The reason they're talking about "energy independence" is because they are preying on American patriotism - and counting on the American public to be stupid enough not to realize how commodities future markets operate. Don't let them fool you.